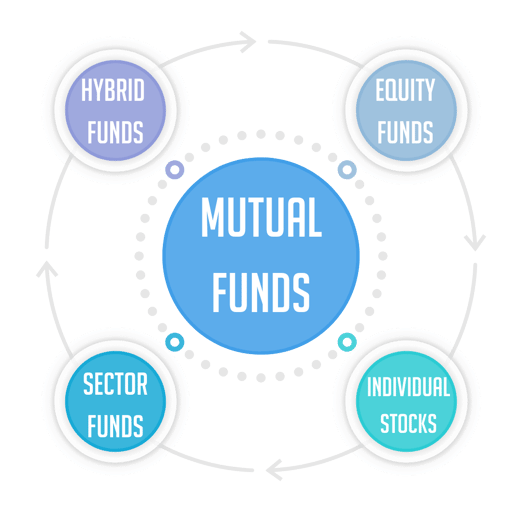

MUTUAL FUNDS

There is no need to worry when you need to buy mutual funds because we offer a wide range of mutual funds that will meet your needs and ensure your safety at the same time!

HYBRID FUNDS

Tata Hybrid Equity Fund

Sundaram Hybrid Fund

HDFC Hybrid Equity Fund

ICICI Prudential Equity and Debt Fund

Our range of hybrid funds offers investors a balanced approach to wealth creation by combining the growth potential of equities with the stability of debt instruments. With options like

Investors can benefit from diversified portfolios that adapt to varying market conditions. These funds aim to deliver consistent returns over the long term while managing risk effectively. By strategically blending equity and debt allocations, our hybrid funds cater to investors seeking a middle ground between capital appreciation and income generation, providing a holistic investment solution for their financial goals.

EQUITY FUNDS

SBI Long Term Equity Fund

Sundaram Tax Saver Fund

DSP Tax Saver Fund

Nippon India Growth Fund

DSP Equity Fund

Sundaram Multi Cap Fund

HDFC Equity Fund

Our suite of equity funds is designed to empower investors with opportunities for long-term capital growth in the dynamic world of the stock market. With options like

Investors gain access to expertly managed portfolios spanning diverse sectors and market capitalizations. These funds are driven by seasoned fund managers who employ rigorous research and strategic investment approaches to identify high-potential stocks. Whether aiming for tax-efficient returns, broad market exposure, or sector-specific growth, our equity funds offer the flexibility and expertise needed to navigate the complexities of equity investing and achieve long-term financial objectives.

SECTOR FUNDS

Our range of sector funds provides investors with targeted exposure to specific industries, allowing them to capitalize on opportunities within those sectors. With options like

UTI Pharma Fund

Investors can focus their investments on a particular segment of the market, such as pharmaceuticals. These funds are managed by experienced professionals who closely monitor industry trends and company performance to make informed investment decisions. By investing in sector funds, investors can potentially benefit from the growth potential of specific industries while diversifying their portfolio. Whether seeking to capitalize on emerging trends or hedge against sector-specific risks, our sector funds offer a tailored approach to portfolio construction and growth.

INDIVIDUAL STOCKS

Investing in individual stocks offers the opportunity for direct ownership in specific companies, allowing investors to align their portfolios with their convictions and outlook on individual businesses. Stocks represent diverse sectors such as paints, auto ancillary, consumer goods, hospitality, and pharmaceuticals. Each stock carries its own unique set of opportunities and risks, influenced by factors such as market dynamics, company performance, and industry trends. By carefully selecting individual stocks, investors can potentially benefit from capital appreciation, dividends, and the ability to tailor their portfolio to their specific investment goals and risk tolerance. However, it's essential for investors to conduct thorough research and analysis before investing in individual stocks to make informed decisions and manage risk effectively.

Kansai Nerolac (Paints, falls under the 'Basic Materials' sector

Gabriel (Auto Ancillary)

Motherson Sumi (Auto Ancillary)

ITC (Consumer Goods)

Indian Hotels (Hospitality)

Dabur (Pharma/Consumer Goods)